The Currency of Trust

The best way to find out if you can trust somebody is to trust them.

Ernest Hemingway, For Whom the Bell Tolls

Nobel prize winning economist Kenneth Arrow argued that trust is an economic good, an “important lubricant of a social system” by reducing transaction costs, standing in for institutions, and mitigating asymmetrical information, the villains of efficient market clearing. It seems to have some bite: a 2001 study by Zak and Knack for example found that a 10% increase in trust (measured via World Values Survey data) correlated with a 0.8% increase in GDP growth.

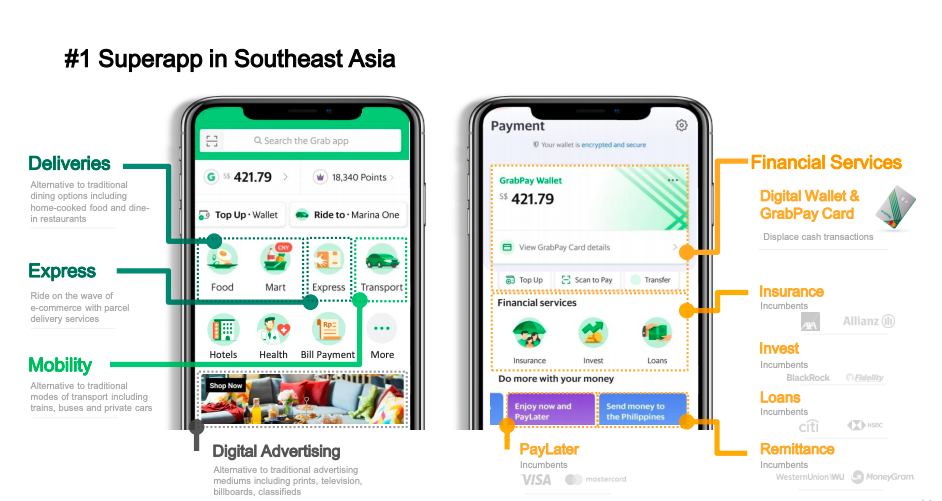

In the part of the world I come from, Southeast Asia, super apps reign supreme, descended from the WeChats and Alipays of China. You can easily find travel, insurance, healthcare, and more in a single screen on many of the larger consumer platforms such as Grab, GoTo, Shopee. When I came to the US, Uber was asking me to download UberEats as a separate application, which befuddled me. Why do I want a whole other separate thingamajig and the subsequent extra swiping when I could easily use the existing Uber interface? (disclaimer: this has evolved quite a bit and it looks like the interfaces are converging)

My hypotheses were first that the logographic nature of Chinese explained the dense, grid-like layout and therefore the visual capacity to cram in more functionality at once. But this UX paradigm extended to mobile applications in Vietnam and Indonesia, countries where their main languages were in Latin alphabets.

Second, that because each slice of US the economy is so deep, you can build multibillion dollar companies just by servicing one niche. As a result, competition for even that one piece is so fierce that diluting your resources and attention across multiple battlefronts was a sure recipe for failure. I think this remains true for the large part on the supply side, but on the demand side, I think trust is the platform. Amazon recently launched Haul, their answer to the rapidly growing SHEINs and Temus of the world, which follows the same compacted layout as the superapps, most likely targeting the mid- to lower-income classes.

:max_bytes(150000):strip_icc():format(webp)/amazonhaul-ad6e951d5bc94573b3550018d5092a54.jpeg)

During the pandemic, I spent six months working with Kunal Shah at CRED on product and strategy. CRED has built a fintech empire on the basis of trust. They began as a credit card bill management application, helping consumers automatically detect duplicate charges, excess fees, etc which were not infrequent issues and concerns for Indian consumers. The crux here is (at that point in time) credit card penetration in India was only about 4%. That means the wealthiest and most credit-worthy of the Indian population, the ones who were able to get credit cards, had a low enough trust relationship with their banking providers that checking for errors was an important value proposition for them.

I suspect that the common denominator across the credit card holders of CRED, the discount buyers of Haul, and the aspiring consumer class of emerging economies like Indonesia is their low trust with the infrastructure and stakeholders that they interact with, resulting in concentration of credibility with the one or two touchpoints that actually treat and serve them well. The Grabs, CREDs, Amazons of the world had earned trust with their consumers in some specific use case, and were able to leverage that to lubricate the cross-selling to other products. The crowded user interface design is not so much an aesthetic choice as the best way to reach their user via the lens of their first trusted interaction with the platform, whether it be bill management or ride hailing or otherwise.

So how is trust created? If we take a Bayesian framework, trust is a probability distribution that is based on prior beliefs and updated with experience. In other words, consistency (some frequency of updating that moves the trust distribution closer to the true value) and integrity (performs as expected).

All this pontification is to say that in a world where AIs are increasingly making decisions for us, where a single touchpoint becomes our window to the world and thereby creating frequent updates of our experience, trust is monopolized by this interface. The more frequent and consistent the user-product interactions, the greater the trust. And consistency doesn’t have to be deterministic. In game systems, rewards are built to be variable - it would get pretty boring if you knew exactly 1:1 how your inputs result in outcomes every time. A 2010 study by Hogarth and Villeval showed that intermittent reinforcement led to more sustained reinforcement of behavior as opposed to greater sustained effort. Variety is the spice of life; having things be a little unpredictable each time can lead to greater habit formation.

So: how many times have you used ChatGPT or Claude or Gemini today?

Comments